The Next #2 — Power

Lithium (from Sweden to Ukraine), a startup doing ice, and some IPOs on top

One of the major running topic of this newsletter will be a shift from bits to atoms in the regional tech scene.

New Nordics become progressively more obsessed with physics-first problems. B2B SaaS is no longer a sole king. It’s not just a vibe-inspired opinion:data on early-stage financing is putting climate and energy at the top.

When I visited one of NATO’s DIANA accelerator open events, the first founder I bumped into was building dual-use fuel cells that could give drones 10X power and range capacity (the company is GaltTec). On the opposite side too, some of Estonia’s biggest rounds of 2023 were done by Skeleton (super-capacitors, €100M+) and Elcogen (hydrogen fuel cells, €45M).

It’s happening.

Li, the king

Mid-January of 2024 proved the shift, in a big way. Swedish battery producer Northvolt raised a $5B debt package to expand its factory, reports Sifted. The sum is staggering, and so are Northvolt’s ambitious — founded by Tesla alumni, the company wants to satisfy Europe’s hunger for EV batteries. The current financing, bringing the total to over $13B, is supposed to enable the production of over 32 gigawatt hours (GWh) of batteries annually.

Sounds good, but it’s a far cry from what’s brewing in the East. China's battery manufacturing capacity is nearly 900 GWh (77% of the global total). It should reach 4,800 GWh in 2025. By 2030, Northvolt sets a target of 150 GWh annual cell production. So decoupling from China is more about at least possessing the technology and manufacturing process in principle, not the actual competition. Still, the New Nordics deserve the praise. Besides Sweden, in Estonia there’s a €200M factory in Narva coming. It will dig rare earth metals and produce magnets. Currently, this market is 99%+ Chinese.

If Europe wants autonomy, that should span across all the chain. We will need A LOT Of lithium to drive those fancy electric Mercedes and Volvo’s. Where to get it?

Most of the world’s reserves are believed to be located in the so-called "lithium triangle" between Bolivia, Chile and Argentina, but the exact data is confusing, as estimates are constantly updated (see this list). In Europe, Czechia seems to have won the golden ticket with its Cinovec deposit, holding around 3-4% of the world’s total reserves. But I would like to focus eastward, as Czech’s ambitions are already recognized and well-funded. Let’s switch to Ukraine, my homeland.

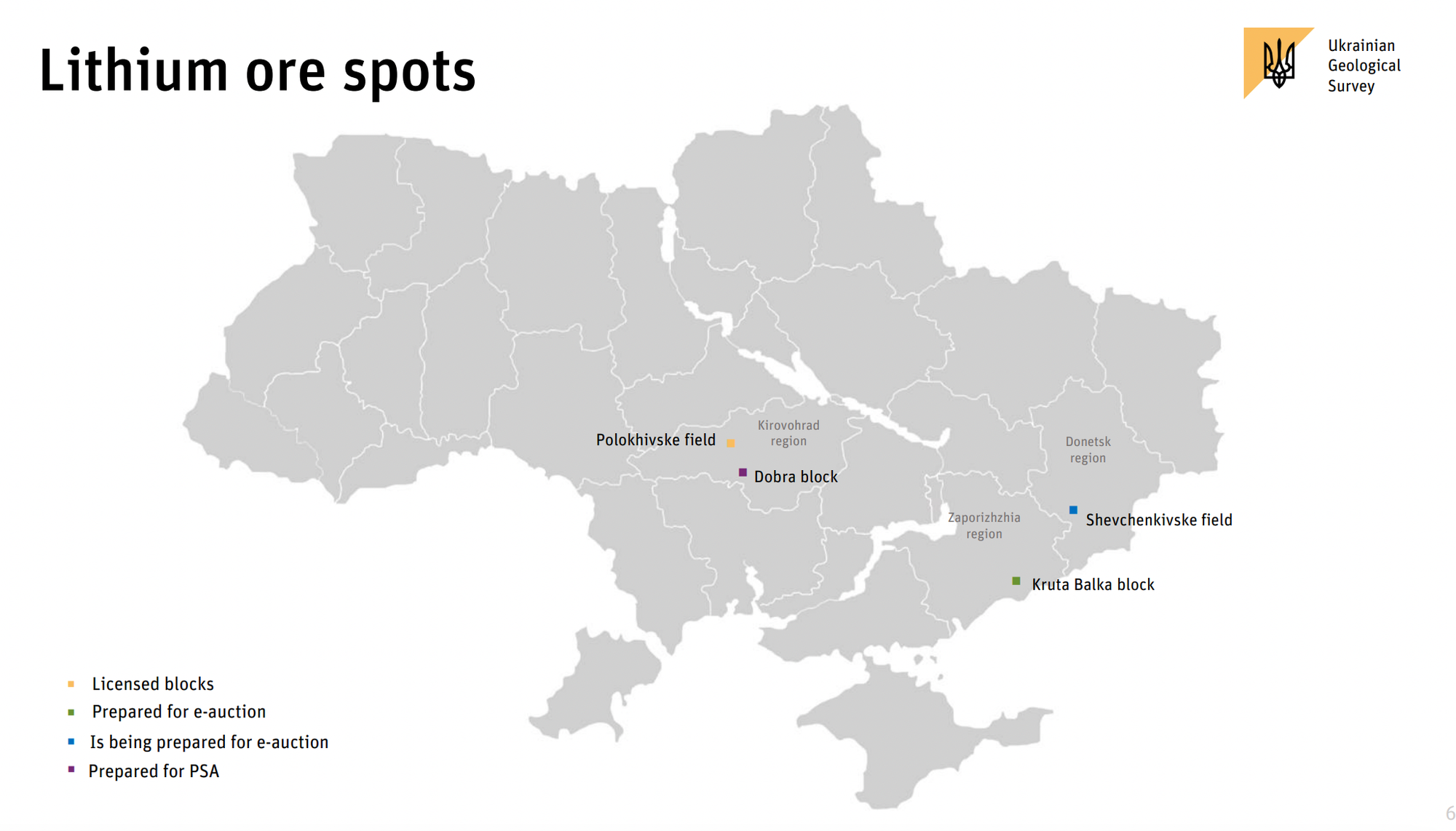

The country is believed to have around 1% of the world’s reserves across 4 major fields, and that’s according to some fairly outdates research from the 80s. Some officials, quoted by Forbes, estimate that 20M EVs could be powered by Ukrainian lithium. That’s 13X to the last year European sales.

Ukrainian ore might be a bit less saturated than Australian or Bolivian one, but the potential is there. Other positive factors I would add: Ukraine has Europe’s cheapest workforce, while possessing the engineering expertise to run large-scale mining and enrichment operations. When needed, the decision-making could be quick. The problem? Two of the reserves are currently beyond the occupation line, in Donetsk and Zaporizhzhia regions. Others are more or less on hold in terms of foreign investment.

Some short-sighted souls say liberating Ukraine is an expensive act of charity. With the upcoming EV revolution, Chinese dominance and the quest for European autonomy, one more argument could be put against it. Could you see some of Europe’s largest lithium facilities running in the newly liberated territories, boosting the hollowed economy? I could, and that seems inspiring.

Opposite to it, I can see a disgusting picture of European cars powered by materials extracted from Ukraine’s occupied territories by Russia. That already happened with coal, then with grain. Lithium might join the list.

At over 600 words by now, this newsletter barely scratched the surface of Li fascinating rise to power. I think we all would benefit from learning more, so for the closing remarks on the topic I will put a list of resources useful for digging in more:

- “Material World” by Ed Conway. Freshly published bestseller about “6 most crucial substances in human history”. Sand, salt, iron, oil, copper and, the most recent addition, lithium. It’s a fascinating account of technical advances and weird chokepoints surrounding the extraction economy. There’s a mine in the middle of Appalachian nowhere that produces quartz crucibles so essential for chip production, that global supply will halt in about 6 months if the facility stops (more by Wired). And for lithium, Conway puts pressure on its recycling feasibility — with recovery rates of around 50%, this seems like a tough choice to power the so-called “green” revolution.

- As for podcasts, there’s a whole Global Lithium Podcast, which I find absolutely fascinating at times. And coincidentally, Northvolt itself started a podcast not long ago, interviewing people who are making their gigafactories and science labs running.

Cooling off

On a more funny note, I would like to featureSifted’s article on the British startup Real Ice (lets gave the UK an honorary membership in the New Nordics to stay on brand).

The team wants to, no less, re-Ice the Arctic with a fleet of hydrogen-powered drones that will dig into thinning ice and spray some water on it, eventually hardening the blocks.

Real Ice will spend the next three years working on testing and building prototypes — it’s currently working in conjunction with the University of Cambridge’s Centre for Climate Repair. After that, it will start its first scaled-up exercise, which will cover 100 km² of ice in Canada.

I find this fascinating! Moreover, the emergence of such weird tech is one more argument for the bits to atoms shift we started from. We used to have really odd apps!

Lastly, Real Ice continues the British tradition of planning incredibly ambitious icing stuff. In WWII, Churchill’s scientific advisor Geoffrey Pyke suggested making a giant artificial airfield from an iceberg, strengthened with some additional materials and potentially even diesel run freezers.

While Washington quickly dismissed the so-called Project Habakkuk as being expensive and impractical, the Brits were quite seriously considering it to the point where a where a prototype measuring 60 feet by 30 feet and weighing 1,000 tons was successfully constructed and maintained in Canada. The spirit of ice innovations is still preserved, as it seems.

Liquidity is coming

Lastly, there’s a list of predicated European tech IPOs published by Sifted (maybe I should run an affiliate program with it?). A lot of promise for the New Nordics: Northvolt + Klarna from Sweden, Vinted from Lithuania and Bolt from Estonia might all list by the end of 2024.

That would be remarkable — the much-needed liquidity will enter the scene, transparency will rise, and the new cycle will begin. The goal of a startup is to cease existing, as TechCrunch puts it, and become a proper, publicly traded business.

I will try to run deep dives on these undertaking (and maybe put it under paywall if enough exclusive will be secured). The road to the market drives internal changes, new top-level hires, and makes many lose their sleep.

Plus, if one is a deep believer in some companies from above, it’s a good time to start setting aside some savings and buy early.

What I read

Last week turned out to be challenging for my reading schedule. I’m currently finishing “Fortress Malta” by James Holland, which covers the heroic efforts of the Maltese to withhold Axis offence on this small, yet strategically important island.

This is a part of my quest to learn more about the Western front, and this chapter does not disappoint. It reads like a thriller. Malta entered war in 1940 being critically undersupplied, then the Royal Navy proceed to greatly cripple Italian naval efforts from there, then the island was once again on the brink and became, in 1942, the most bombed place on Earth.

It was not unusual for the defenders to fly 5-against-200 aircraft sorties at some point. Starving on rationed, 1500 calories per day, rations, they persisted and were finally helped thanks to the operation Pedestal, which set in power the collapse of Italy. No wonder the whole island received George Cross, British highest award.

Highly recommend! Holland's book on the Sicily invasion (which followed Malta’s rescue) is also superb.

Feedback and sTARTUp day

I hope you enjoyed the read. This newsletter is still very much a thing in the making.

If you have some suggestions or constructive criticism, please feel free to reach me at michail@sapiton.me.

Final note. I will be attending sTARTUp day (24-26th of January) in Tartu, Estonia — we can mingle there as well.